By Tarso Veloso

At a Glance

- On June 13, the U.S. Environmental Protection Agency (EPA) proposed higher biofuel blending requirements for 2026 and 2027

- As the shift toward renewable fuels boosts soybean oil demand, Soybean Oilshare futures and options offer a streamlined approach to trading the relationship between soybean oil and soybean meal

As demand for animal protein and vegetable oils continues to rise globally, roughly 85% of all beans harvested are crushed into two primary products: soybean oil and soybean meal. Soybean meal, a high-protein animal feed, is a staple in the agricultural industry, while soybean oil has applications in food, fuel and industrial sectors.

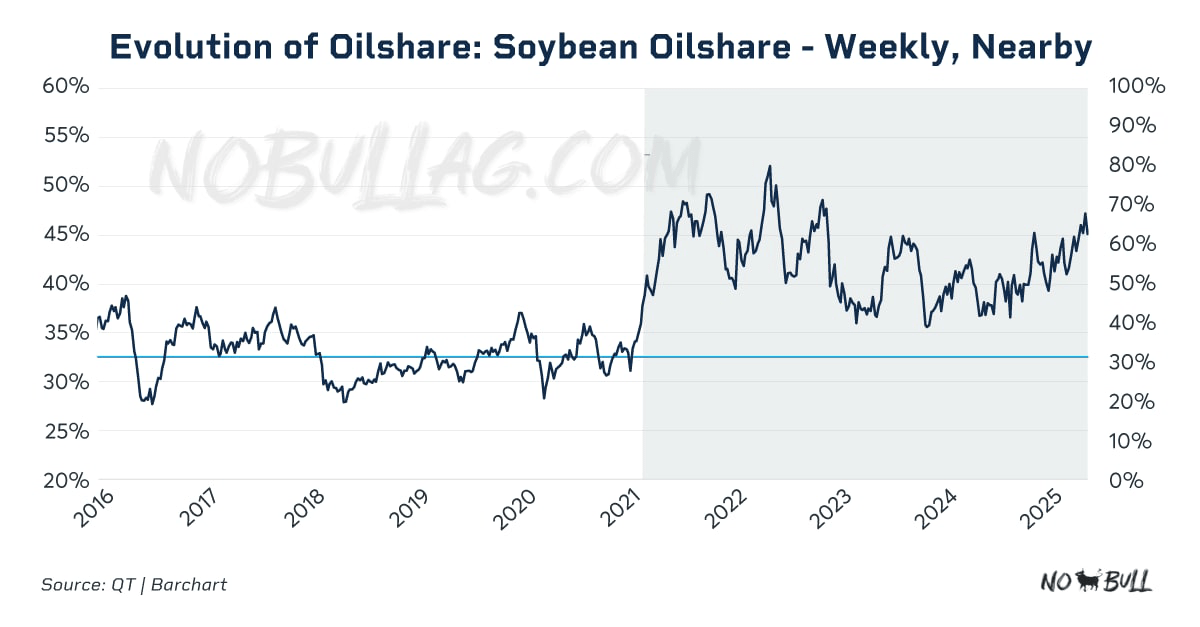

With so many applications, the soybean market is a multifaceted environment where the value of soybean oil and soybean meal can vary considerably. A pivotal measure that supports market participants in negotiating this complexity is oilshare, a term used to describe the value share of the soybean crush attributable to soybean oil. With the growth in renewables driving more soybean processing around the world, the concept of oilshare has gained prominence as soybean oil is increasingly utilized in the production of biomass-based diesel fuel.

This rise in demand and the necessity to hedge price changes have fuelled the development of Soybean Oilshare futures and options, which provide a more efficient way for market participants to navigate this relationship. I recently had a conversation with Susan Stroud, founder and analyst at No Bull Agriculture, to get her thoughts on the state of the soybean market, the potential risks ahead, and the importance of understanding oilshare.

Tarso Veloso: Price changes in soybean oil and soybean meal directly impact oilshare. What are you seeing in terms of soybean production?

Susan Stroud: 2025 marks the fourth consecutive record year of global soybean production, and this is unsurprisingly resulting in record ending stocks in terms of both quantity and stocks as a percentage of overall demand.

On the demand side, we also see record exports and global crush, supported by growing protein demand and expanding biofuel mandates.

Tarso Veloso: Soybean oil plays an important role as an input in biofuels. How do you see demand for renewable fuels impacting the soybean market?

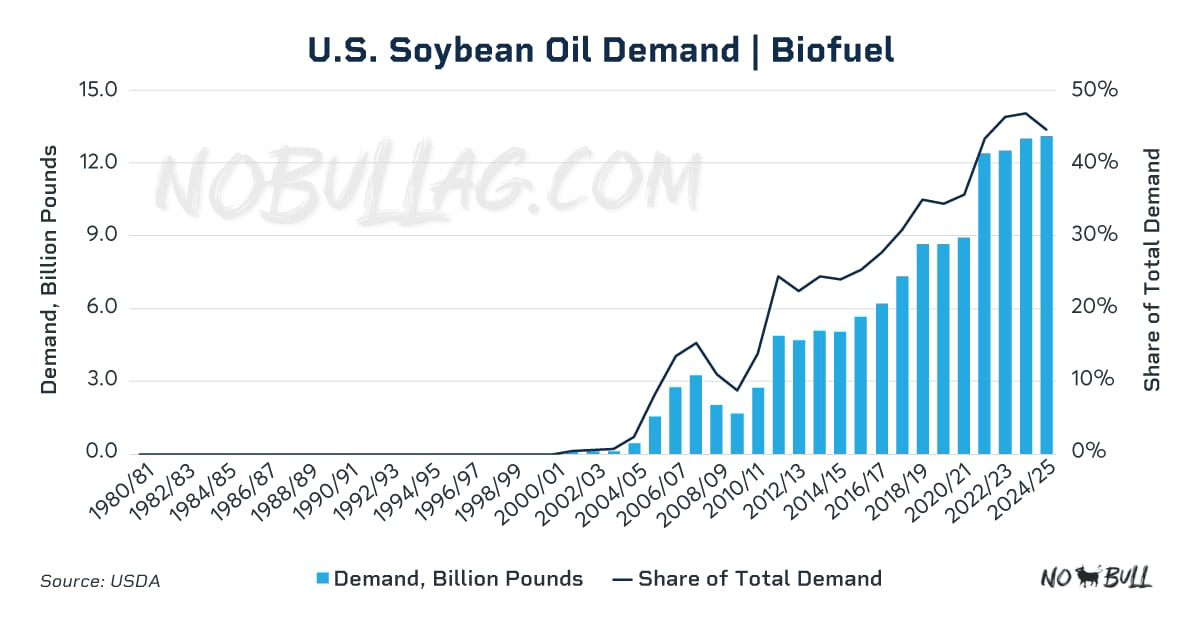

Susan Stroud: Historically, soybeans have been crushed for their protein-rich meal, used to feed livestock. However, in recent years, the soy complex has undergone a notable transformation as expanding biofuel mandates and the adoption of low carbon fuel programs have created a surge in demand for soybean oil.

This shift has altered traditional price dynamics, with soybean oil now becoming a key driver in the complex, and this trend is expected to continue as the renewable fuel sector expands.

Tarso Veloso: These considerations have contributed to the development of Soybean Oilshare futures and options. Why is a contract like this important in the current market environment?

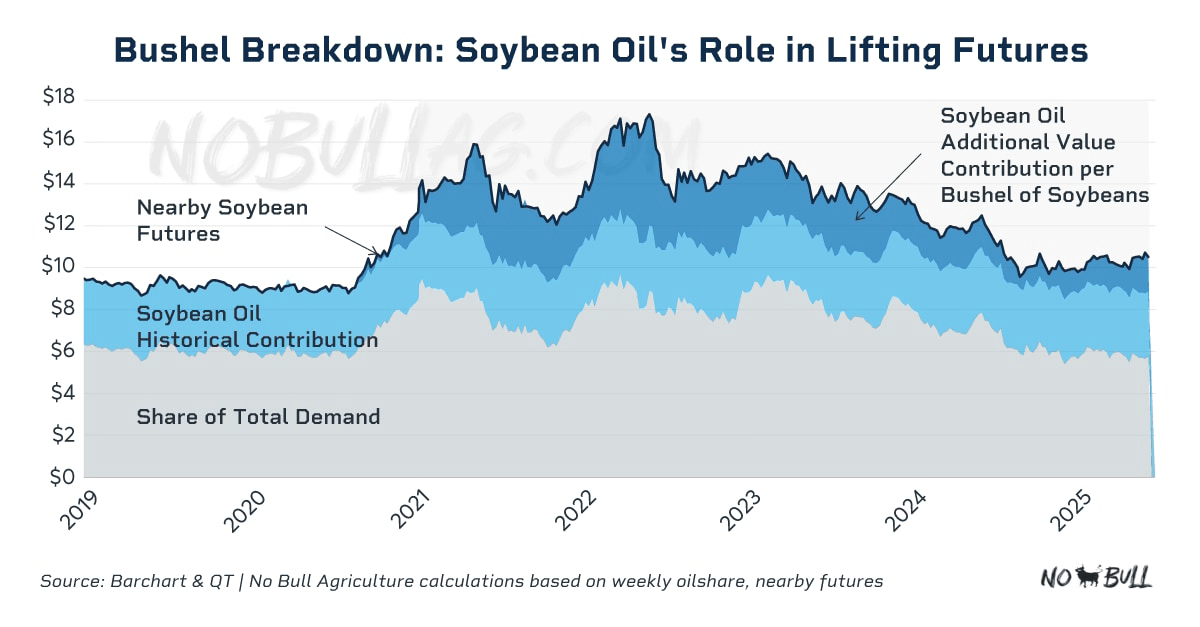

Susan Stroud: Things have changed. In this new era of demand, soybean oil contributes more value to each bushel of soybeans than ever before. This increase in oil’s ‘share’ has become a fundamental driver in the soy complex and added real value to every bushel of soybeans.

However, this heightened volatility and sensitivity to oil price fluctuations also introduces significant risk for market participants. The Soybean Oilshare futures and options contract provides a crucial tool to manage this risk.

By allowing for the direct hedging and trading of the oil’s contribution to the overall soybean value, it empowers producers, processors, and end-users to navigate the evolving market landscape with greater precision and confidence.

Tarso Veloso: What do you see as the biggest risks in the soybean market in the near term?

Susan Stroud: Near-term, policy volatility poses a major risk.

For nearly two decades, the United States maintained a policy that provided a $1-per-gallon blending credit to entities such as biofuel producers, truck stops and petroleum companies for each gallon of biomass-based diesel blended into domestic petroleum supplies. This incentive applied not only to domestically produced biofuels but also to imported biofuels, ultimately encouraging substantial volumes of biofuel imports into the U.S. market.

However, this policy expired at the end of 2024 and was replaced by the Clean Fuel Production Credit, known as 45Z, in January 2025. The new framework introduces two significant changes. First, imported fuels are no longer eligible for the credit. Second, and most notably, the flat $1-per-gallon incentive has been replaced by a sliding-scale credit based on the carbon intensity of the fuel. Under this system, crop-based biofuels receive smaller credits, while fuels produced from waste feedstocks are eligible for higher subsidies.

Soybean oil commands a substantially smaller premium under the new policy due to its relatively high carbon intensity. As a result, the shift from the long-standing $1-per-gallon 40A blending credit to the 45Z production credit – which favors lower-carbon-intensity feedstocks – has already led to significant market disruption in early 2025.

This policy change significantly reduced biomass-based diesel production and, consequently, demand for soybean oil as a feedstock. Although 45Z was signed into law in August 2022, official guidance was not released until January 10, 2025. The market’s swift response to these details underscores the immediate impact and volatility associated with policy risks.

Editor’s Note: On June 13, the U.S. Environmental Protection Agency (EPA) proposed new Renewable Fuel Standard (RFS) volume requirements for 2026 and 2027. If finalized, these would be the highest mandated biomass-based diesel volume in the history of the RFS program, according to the press release.

Tarso Veloso: Are there any other longer-term risks you’re monitoring?

Susan Stroud: Longer term, we will continue to see a global push for green energy but need to remain mindful of the headwinds crop-based biofuels face as incentives and initiatives are increasingly tied to carbon intensity, leaving waste-based biofuels advantaged. Sustainability and regulatory pressures will only mount from here.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here