Re-Rating Healthcare Amidst Stagflation and Technology Vulnerabilities

The Political Shift and Its Implications on Healthcare

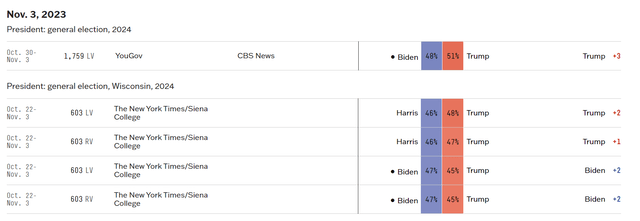

Historically, the biotech and health index has endured periods of underperformance; we believe a substantial reason driving the healthcare stocks to underperform can be attributed to the overhang of government intervention. Particularly, policies such as the IRA capping drug price increases and potential governmental contracts have exerted downward pressure on the earnings of big pharma and biotech companies. This has been further accentuated by the Democratic administration’s approach towards these industries. However, recent polling data suggests a potential reversal in this trend. Indications of a probable Republican win point towards a possible policy revision, especially those that the Democratic regime has been arduously pushing for. Such a political reshuffling, if it transpires, could prove to be the wind beneath the wings of the healthcare sector. The end of 2023 and 2024 might just turn out to be pivotal years wherein the market could re-rate healthcare stocks, paving the way for a substantial upside.

538 poll data (538 poll data)

Stagflation Fears and Its Differential Impact on Tech vs. Healthcare

An emergent concern on the economic horizon is the specter of stagflation. The Federal Reserve’s stance of maintaining a high-interest rate, coupled with persistent inflation, is setting the stage for such an economic scenario. This is further exacerbated by geopolitical tensions in regions like Ukraine and Israel, which have a direct bearing on global oil and commodity prices. In such a backdrop, the technology sector appears particularly vulnerable. A significant portion of tech companies derive their revenues from consumer discretionary services. For instance, during economic recessions or periods of reduced disposable incomes, non-essential services like Netflix subscriptions can be the first to face the consumer’s axe. In contrast, the healthcare sector boasts of inherent resilience. Irrespective of economic conditions, patients necessitate medicines, offering a non-discretionary nature to healthcare revenues. Even if the US IRA holds its policies, it will likely allow pharmaceutical companies to adjust prices in tandem with inflation. Thus, healthcare not only presents robust growth prospects but also positions itself as a potent hedge against inflation.

The M&A Dynamics in Biotech and Contrasting Tech Valuations

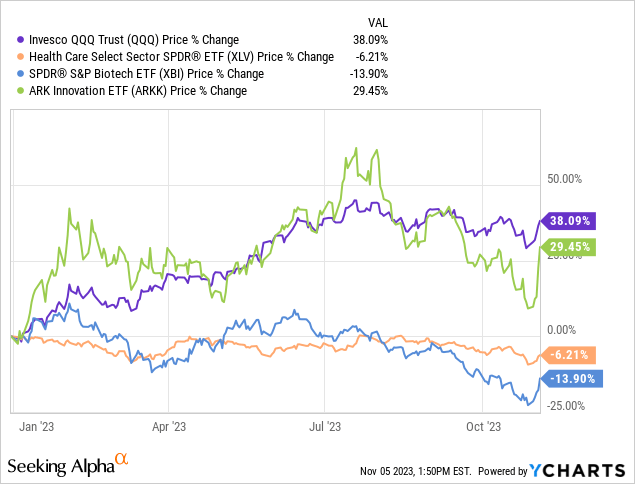

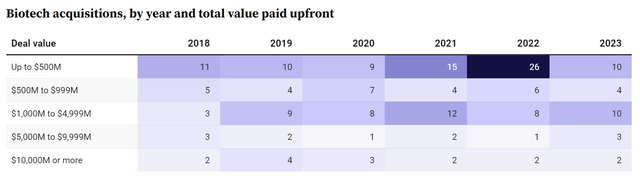

Biotech M&A activity has been on the ascent, and the premiums attached to these transactions are witnessing a northward journey. This trend stands in stark contrast to the biotech index, XBI, which is currently languishing at near-historic lows. This divergence presents a compelling risk-reward proposition for potential investors in the biotech space. On the other hand, tech ETFs are hovering close to their all-time highs. A considerable impetus for this rally has been the euphoria surrounding Artificial Intelligence, which has catapulted stocks like NVIDIA (NVDA) to stratospheric levels. While AI undeniably offers immense growth potential, the current valuations pose questions about the sustainability of such lofty prices, especially when juxtaposed with the aforementioned macroeconomic concerns.

Biopharmadive database (Biopharmadive)

Why Short ARKK/QQQ for Tech Downturn?

ARKK (ARK Innovation ETF) and QQQ (Invesco QQQ Trust) are some of the most well-known ETFs that track the technology sector and broader innovative companies.

-

ARKK’s Exposure: ARKK is heavily invested in disruptive technologies and companies that are believed to be leading innovation in their respective fields. Companies in ARKK’s portfolio include Tesla, Roku, and Square, which have seen exponential growth but are vulnerable during economic downturns due to their high valuations.

-

QQQ’s Exposure: QQQ tracks the NASDAQ-100 index, which consists of 100 of the largest non-financial companies listed on the NASDAQ stock exchange. This makes QQQ more concentrated in tech with companies like Apple, Microsoft, and Amazon.

Pros of Shorting ARKK/QQQ:

- High Volatility: Especially in ARKK, the emphasis on high-growth stocks means that a tech downturn can lead to significant price drops.

- Broad Exposure: QQQ gives a comprehensive view of the tech downturn, given its extensive tech holdings.

Cons of Shorting ARKK/QQQ:

- Potential for Rebound: Given the innovative nature (or hyped up nature) of the holdings, they have the potential for unexpected positive news leading to rebounds.

- Dividend Yields: QQQ has decent dividend yields which shorts would have to pay.

Why Go Long on XLV/XBI for Healthcare Upside?

XLV (Health Care Select Sector SPDR Fund) and XBI (SPDR S&P Biotech ETF) track the healthcare sector, with different focuses.

-

XLV’s Exposure: XLV is more diversified, covering a broad range of healthcare-related stocks. Its holdings include pharmaceutical giants like Johnson & Johnson, Pfizer, and Merck, as well as healthcare providers and medical device companies.

-

XBI’s Exposure: XBI is more focused on the biotechnology sector, making it riskier but also offering more growth potential. It covers both established companies and up-and-coming ones.

Pros of Going Long XLV/XBI:

- Diversified Health Exposure: Especially with XLV, investors get broad exposure to the healthcare sector.

- High Growth Potential: With XBI, the focus on biotech means that positive news or drug approvals can lead to significant stock price jumps.

Cons of Going Long XLV/XBI:

- Volatility: XBI, due to its focus on biotech, can be more volatile.

- Regulatory Risks: Any unexpected changes in healthcare regulations can impact both ETFs.

ARKK and QQQ, given their exposure to tech and innovative companies, would then logically be the ETFs most impacted by such a downturn, making them ideal candidates for shorting.

Conversely, the thesis also suggests a potential re-rating for the healthcare sector, propelled by favorable political shifts and the sector’s inherent resilience. XLV, with its diversified healthcare exposure, and XBI, with its targeted biotech focus, stand to benefit immensely from this uptrend, making them sound choices for a long position.

In conclusion, strategically shorting ARKK/QQQ and going long on XLV/XBI aligns well with the anticipated sectoral trends. This approach capitalizes on the potential tech downturn while harnessing the expected upside in healthcare, allowing for a comprehensive investment strategy.

Additional ETFs to consider

| ETF | Category | Pros | Cons |

|---|---|---|---|

| VHT (Vanguard Health Care ETF) | Healthcare | – Diversified exposure to the healthcare sector – Lower expense ratio | – Might have less aggressive growth compared to biotech-focused ETFs – Regulatory risks |

| IBB (iShares Nasdaq Biotechnology ETF) | Healthcare | – More focused on biotechnology companies – Potential for high returns in case of positive drug trials | – Higher volatility – Regulatory risks |

| IHI (iShares U.S. Medical Devices ETF) | Healthcare | – Targets medical device companies which might be less susceptible to drug pricing regulations – Potential stability | – May not have as high growth as biotech ETFs – Vulnerable to changes in healthcare policy |

| SOXX (iShares PHLX Semiconductor ETF) | Tech | – Exposed to the semiconductor industry, essential for tech innovation – Can have defensive characteristics in tech downturn | – Vulnerable to supply chain disruptions – Sector-specific concentration risk |

| XLK (Technology Select Sector SPDR Fund) | Tech | – Broad exposure to the tech sector – Includes blue-chip tech stocks that might be somewhat resilient | – Still susceptible to discretionary spending and macroeconomic issues – May not capture niche tech trends |

| SKYY (First Trust Cloud Computing ETF) | Tech | – Focus on cloud computing, an essential and growing sector – Diverse exposure within tech | – High valuations could lead to a downturn in a stagflation scenario – Dependent on continuous corporate IT spending |

Analysis Based on our thesis:

-

Healthcare ETFs: Given that our thesis is that healthcare is poised for a positive re-rating, ETFs like VHT, IBB, and IHI offer different levels of exposure to the sector (as analyzed in detail above). VHT provides a broader base, IBB targets high-growth biotech, and IHI offers a blend of stability and growth.

-

Tech ETFs: Considering our anticipation of a tech sector downturn exacerbated by stagflation and geopolitical concerns, tech ETFs like SOXX, XLK, and SKYY present various risk-reward profiles. While all would potentially be impacted, niche-focused ETFs like SKYY and SOXX might have differential impacts based on industry-specific news.

Risks

While the thesis of going long on healthcare and short on tech presents a strategic approach based on current trends and geopolitical insights, several risk factors could challenge its success.

Firstly, political dynamics are unpredictable; even with polls favoring Republicans, the actual policy outcomes, especially concerning healthcare regulation, remain uncertain until implemented. The tech sector, despite its current challenges, has historically shown resilience and adaptability. Breakthrough innovations or favorable regulatory decisions could drive unexpected growth, invalidating a short position.

Additionally, global geopolitical events, like wars or trade agreements, can have unforeseen consequences on both sectors, either through supply chain disruptions for tech or global health crises bolstering healthcare. Stagflation, while detrimental to many industries, might not affect the tech sector uniformly, with certain sub-sectors potentially thriving.

Moreover, healthcare, even in recessions, isn’t entirely immune to economic downturns. Price capping or public sentiment against pharma due to issues like perceived profiteering could negatively impact the sector. Lastly, external black swan events – unpredictable and rare occurrences – could upend any predictions, adding an inherent layer of risk to any investment thesis.

Scenario Analysis

1. Both Sectors Move as Anticipated:

- Outcome: This is the ideal scenario for our thesis.

- Healthcare (Long Position): The healthcare sector experiences an uptick, perhaps due to favorable political shifts, regulatory relaxations, increased M&A activity, or other positive sectoral news. The ETFs associated with this sector, like XLV and XBI, see gains.

- Tech (Short Position): The tech sector faces a downturn, possibly due to concerns over inflation, stagflation, geopolitical events, or simply market adjustments after a prolonged period of high valuations. ETFs like ARKK and QQQ depreciate in value, which benefits the short positions.

2. One Sector Moves as Anticipated, the Other Remains Neutral:

- Outcome: Moderate success for the thesis.

- Scenario A: Healthcare sector sees gains, but the tech sector remains stable, neither appreciating nor depreciating significantly.

- Scenario B: Tech sector faces a downturn as predicted, but healthcare remains stable without significant gains.

3. One Sector Moves Against the Anticipated Direction, the Other Moves as Anticipated:

- Outcome: Mixed results, which could lead to either marginal gains, break-even, or losses.

- Scenario A: Healthcare sector faces unexpected challenges leading to a downturn, while the tech sector depreciates as predicted.

- Scenario B: Tech sector experiences unexpected growth or resilience, while the healthcare sector appreciates as predicted.

4. Both Sectors Move Against the Anticipated Direction:

- Outcome: This is the least favorable scenario for our thesis.

- Healthcare (Long Position): Against expectations, the healthcare sector faces a downturn. Factors could include unforeseen stringent regulations, negative news related to prominent companies, or unsuccessful drug trials.

- Tech (Short Position): The tech sector rebounds or remains resilient, possibly due to innovative breakthroughs, strong earnings reports, or broader macroeconomic factors favoring tech.

5. Both Sectors Remain Neutral:

- Outcome: Neither significant gains nor losses. Both the healthcare and tech sectors remain relatively stable without any major movements.

Conclusion

We plan to long healthcare into 2024 and short the over-hyped technology sector. The core ETFs that we are considering are longing for a 50% 50% mix of XBI and XLV and short a 50% 50% mix of ARKK and QQQ to balance the risk. The key rationale for choosing the following ETFs is described in more detail above in our article. The confluence of political, economic, and industry-specific factors presents a compelling case for a positive re-rating of healthcare stocks, especially as we approach the cusp of 2024. On the flip side, the technology sector, though groundbreaking in its offerings, appears susceptible to the current macroeconomic headwinds. The inherent resilience of the healthcare sector, bolstered by favorable political winds, positions it as a robust investment avenue. In contrast, the elevated valuations in tech, combined with its vulnerability to discretionary spending cuts, make it a less attractive proposition in the present scenario. In the balance of risks and rewards, healthcare emerges as a more compelling proposition.

Read the full article here