Summer 2025 Market Commentary

Markets have been a rollercoaster for investors in 2025, with every major benchmark starting the year down in the first quarter to all being up for the second quarter and year-to-date. Thanks to a recovery in big tech, the S&P technology and communications sectors were the best performing for the quarter. The industrial and financial sectors also reached new highs indicating that the economy is holding up better than expected despite trade tensions. The most aggressive tariff policies were postponed temporarily as the administration has shown it will alter plans if markets react dramatically on the downside. This pause led to a pull forward in demand as companies rushed to beat the tariff deadlines. Strong capital spending in Artificial Intelligence (AI), power generation, bank deregulation and the reshoring of manufacturing have offset the uncertainty of higher tariffs which are now six times higher than when Trump entered office and the highest since the 1930s. The recently passed 100% bonus depreciation and immediate research and development expensing are further accelerating the boom in spending on new plants and equipment. Prolonged trade wars have not materialized so far and we have yet to see the full impact as many countries have been developing new trading relationships. As of June 5, S&P 500 companies had authorized a record $750 billion in stock buybacks this year, up from the $600 billion for the same time in 2023 and 2024 according to LPL Financial. Projections for the full year 2025 exceed $1.2 trillion.

Bonds continue to trade in a bear market which has now been in a drawdown for fifty-nine months, the longest in history according to market researcher Charlie Bilello. Near-zero bond yields in early 2020 left little room to defend against the Fed’s rate hikes and persistent inflation that followed, and prices have yet to reach new highs since.

Alphabet’s Strength Amid Growing AI Disruption

AI disruption has been a growing concern for many investors as they are uncertain of the long-term consequences of this technology. Alphabet (GOOG)(GOOGL) has been at the front of AI disruption discussions. Some feared the impact of generative AI tools like ChatGPT on Google Search, but Alphabet has been proactive in defending their moat in search by releasing their own tools. Despite the rapid increase in generative AI use, Google Search still controls about 89.71% of the global search market. The biggest hurdle that AI companies like OpenAI face is that generative AI products are difficult to monetize and are not yet profitable, which gives Alphabet a distinct advantage in search right now. Another strength is Alphabet’s content services like YouTube. According to Nielsen data, YouTube accounts for 12.5% of all US TV viewing time, higher than any other distributor, without needing to spend billions on creating content for their platform. Netflix is spending over $20 billion for their content this year. With Google and YouTube, Alphabet has the two most visited websites in the world; YouTube has over four times as many monthly visits as the next closest competitor. Alphabet’s dominant market position is enhanced with a strong balance sheet currently consisting of over $95.148 billion in cash and marketable securities. Alphabet continues to execute, forecasting 2025 and 2026 earnings per share of $9.65 and $10.25, respectively. Additional uncertainty overhangs the stock from Judge Mehta’s anticipated ruling on the “search monopoly” claim due in August. While he has not ruled out the possibility of significant remedies such as forcing a sale of Chrome, he has voiced skepticism over the effectiveness of structural breakups.

US Dollar Suffers Worst First Half in Decades

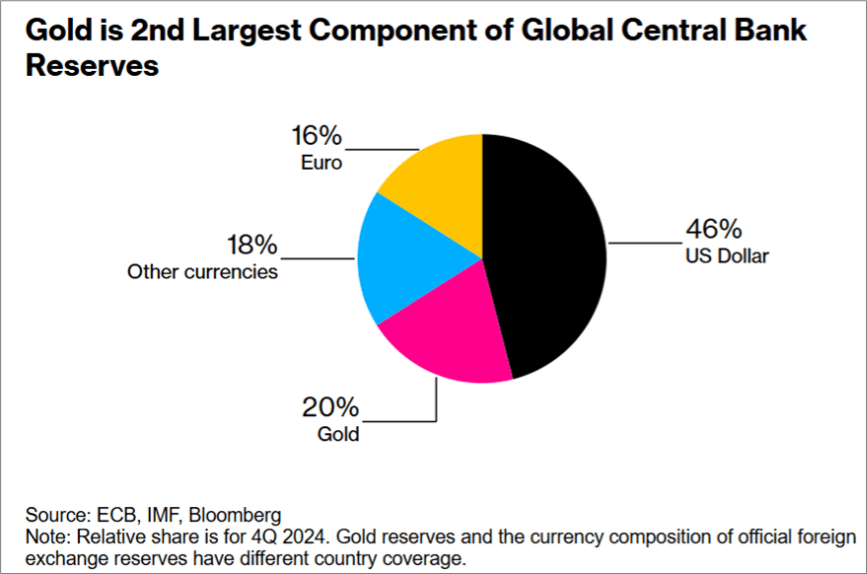

After closing out 2024 at record highs the US Dollar Index, which measures the value of the Dollar against the world’s six most traded currencies, fell nearly 11% in the first half of 2025. This makes it the worst half year for the index since 1991 and the worst first half since the 1973 oil crisis. The decline has been driven by factors like tariffs and the threat of trade wars which have led to uncertainty over the safety of the Dollar. Central banks and private investors have been diversifying into other currencies or assets. China has added to their gold reserves for eight consecutive months even as prices reach all-time highs in an attempt to further diversify away from the Dollar. Other countries like Russia, Brazil, Iran and even Saudi Arabia are moving to at least a more diversified currency strategy. Still, the US Dollar remains the dominant reserve currency. At the end of 2024 it accounted for 46% of global central bank reserves, more than double the next closest currency, gold.

Dollar reserves are also nearly three times as high as the next closest country’s currency. With the currency being so engrained in the global economy it is unlikely to be replaced anytime soon.

Strong Travel Industry

One of the most negatively impacted industries during the pandemic was travel as most countries enacted some kind of restrictions during that time. The industry has also been one of the slowest to recover from the pandemic, but we are finally seeing it return to more normal levels. In the US, the Transportation Security Administration (TSA) is setting records. On June 22, TSA screened nearly 3.1 million individuals, the most ever in the single day. So far seven of the top ten business travel days in TSA history have occurred over the last two months. The recovery has also been evident globally. We are participating in this trend through Booking Holdings whose revenues and earnings have exceeded pre-pandemic highs. They aggressively adapt to changing technologies such as AI to streamline the booking process and provide more value to their users. Looking forward, the World Travel & Tourism Council estimates that global travel will contribute an all-time high of $11.7 trillion to the world economy in 2025, which would be around $164 billion above the 2019 peak. Mastercard and Visa’s cross-border payments account for 30%-40% of their transactions. They directly benefit from higher international travel and e-commerce transactions between countries.

Apple’s (AAPL) Contrary View on AI and the Illusion of Thinking

AI technology continues to draw investors’ attention as corporations pour billions into expanding AI compute capabilities. The largest tech companies expect to spend over $300 billion on infrastructure for cloud and AI in 2025 alone. At the end of 2024, Bloomberg reported that the global AI market could reach $1 trillion by 2027. A research paper from Apple released during the quarter explored how large language models (LLMs) handle complex problems. What they found is that today’s LLMs only present an illusion of thinking and reasoning and only produce results based on the most likely patterns. These models can handle less complex puzzles but once a certain level of complexity is reached they all break down and give up, even when researchers provide exact step-by-step instructions for solving them. The study showed that LLMs don’t reason in the same way as humans do and they can’t adapt or learn from instructions. The main conclusion was that AI as it stands today simply looks at patterns in data and produces the most likely result instead of “thinking” through a question or problem. Studies like these could indicate that we may be much farther from artificial general intelligence (AGI) and solving the problem of “thinking” than one would expect when looking at AI tools today.

Second Quarter 2025 Performance Update

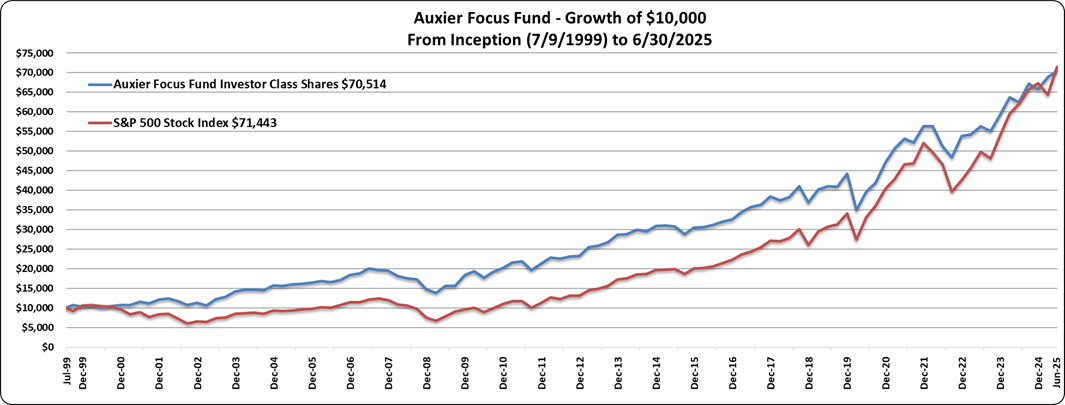

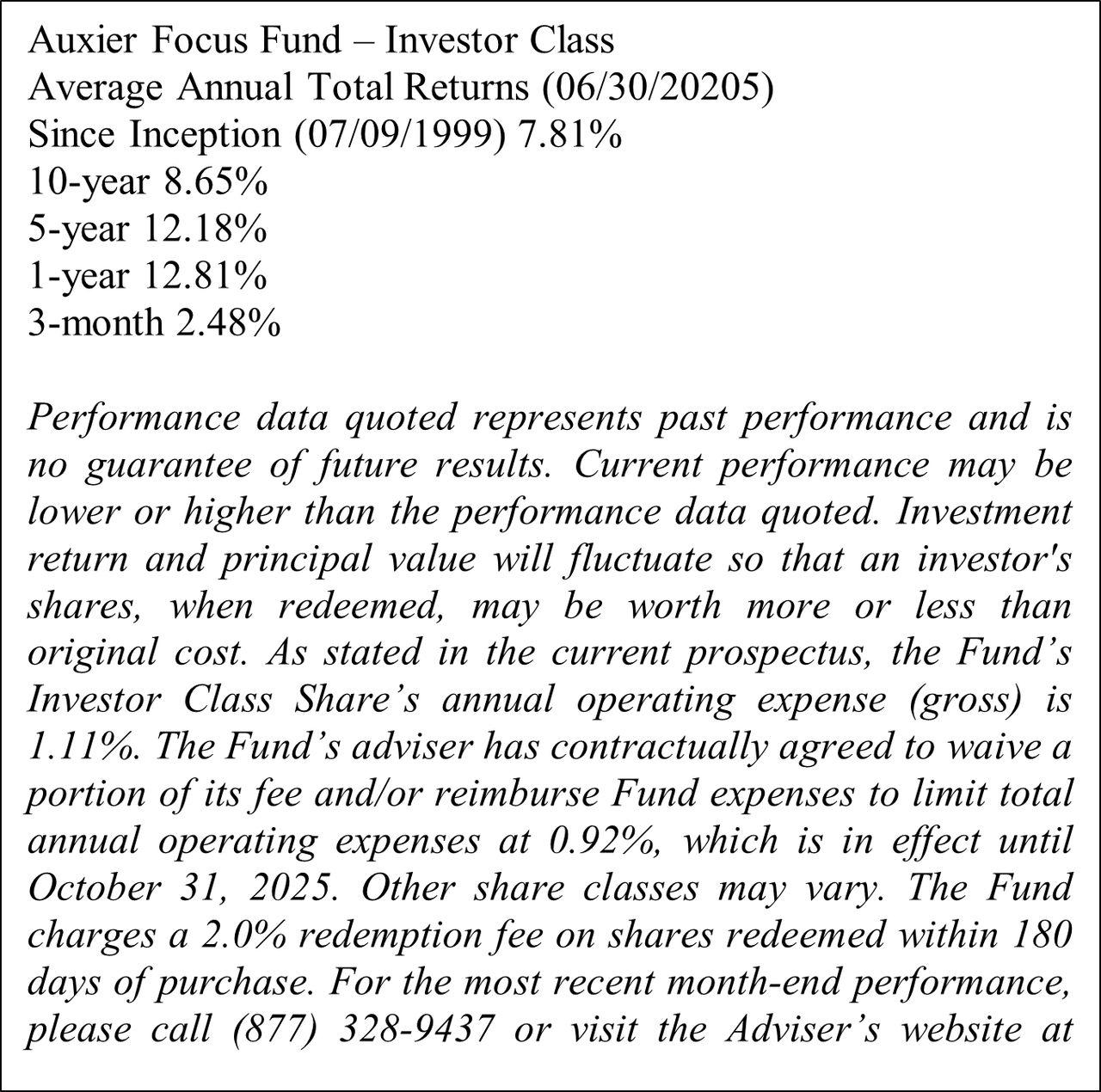

Auxier Focus Fund’s Investor Class gained 2.48% in the second quarter of 2025. For the same period the S&P 500 cap-weighted index and the equal weight returned 10.94% and 5.46% respectively. The Russell 1000 Value was up 3.79%. For the first six months equities in the Fund gained 8.72% and for the 12-months ended 6/30/25 the stocks in the Fund returned 15.26% while the Fund gained 12.81%, vs 15.16% for the S&P 500. For the quarter, fixed income investments as measured by the S&P US Aggregate Bond Index returned 1.22% and the longer-dated ICE US Treasury 20+ Year Index declined 1.95%. Stocks in the Fund comprised 94.2% of the portfolio. The breakdown was 85.3% domestic and 8.9% foreign, with 5.8% in cash and short-term debt instruments. A hypothetical $10,000 investment in the Fund since inception on July 9, 1999 to June 30, 2025 is now worth $70,514 vs $71,443 for the S&P 500 and $58,710 for the Russell 1000 Value Index. For the same period, equities in the Fund (entire portfolio, not share class specific) have had a gross cumulative return of 1,189.24%. The Fund had an average exposure to the market of 82% over the entire period. Our results are unleveraged.

Contributors

Information Technology was the strongest sector in the Fund thanks to the rapid recovery of tech stocks which crashed with the shocking introduction of draconian tariffs. The first quarter was dominated by fears of a possible recession, but strong second quarter earnings specifically from tech companies helped alleviate these fears. Companies like Alphabet, Meta Platforms (META), Corning (GLW) and Microsoft (MSFT) are all showing improving fundamentals in the cloud and AI even in the face of massive capital spending. Aerospace has solid earnings as well. CAE (CAE) is a leader in global pilot training which is mandated for all commercial pilots.

We are always looking for exceptional founder-led companies with heart and soul. Back in 2010 we met Scott Shaw, the CEO of Lincoln Educational, which offers programs developing skilled technicians. His pivot to satisfy the demand for electricians has contributed to a huge quadruple-play return for shareholders during his tenure. The company saw a 45% stock gain for the quarter. According to Forbes, for every five retiring skilled workers only two are being replaced. As long as there is a skilled labor shortage in the US Lincoln Educational (LINC) should continue to benefit.

Detractors

Healthcare was the weakest performing sector in the Fund with health insurance companies being hit the hardest. Insurance companies experienced higher medical loss ratios (MLRs) from greater utilization which led to lower-than-expected earnings. New spending bills in the US raised uncertainty over how they would impact future healthcare coverage and margins. Companies like UnitedHealth (UNH), Cigna (CI) and Elevance (ELV) underperformed relative to the Fund. UnitedHealth’s reappointed CEO Stephen Hemsley has a proven record of outperformance running the company from 2006-2017. He recently purchased 86,700 shares at $288.57. Other insiders including CFO John Rex have been aggressive buyers of the stock. In the past 12 months UNH insiders have purchased 110,408 shares while only selling 1,290. Elevance CEO Gail Boudreaux recently bought 8,500 shares of ELV at around $287. These businesses have high free cash flow yields and large investment portfolios which act as a ballast for earnings. Pricing for Medicare Advantage (MA) will increase by 5.06% in 2026, which should help boost next year’s earnings. Medical device companies suffered from tariffs and lower guidance. Abbott Laboratories (ABT), Becton Dickinson (BDX) and Zimmer Biomet (ZBH) were impacted by higher costs and lower demand. According to a recent Goldman Sachs study of S&P 500 sector valuations, healthcare stocks are the cheapest for both the ten-year and thirty-year averages.

Risks

The unpredictable, haphazard and aggressive nature of tariff implementation and other policies by President Trump have added to risk and volatility for a great number of industries. We have yet to see the full impact of the increase in tariff rates, especially as many importers pulled forward sales ahead of deadlines and trading partners are seeking new relationships. The rapid advances in AI are creating material disruptions across numerous industries. We’re working hard daily to assess the impact. Speculation in the markets has risen dramatically as margin debt levels reached a record high of $1.008 trillion in June.

In Closing

In one quarter the market has transitioned from extreme risk aversion to speculative, low quality “risk on.” We remain committed to a rigorous, rational research approach striving to develop a deeper understanding of the competitive strengths and managerial diligence of individual businesses. Earnings drive stock values and we try to stay focused on the underlying operating realities. Cumulative knowledge of businesses and industries over years can add significant value in mitigating risk, especially in times of market and economic turmoil.

We appreciate your trust.

Jeff Auxier

|

Before investing you should carefully consider the Fund’s investment objectives, risks, charges and expenses. This and other information is in the prospectus, a copy of which may be obtained by calling (877) 328-9437 or visiting the Fund’s website. Please read the prospectus carefully before you invest. Fund returns (i) assume the reinvestment of all dividends and capital gain distributions and (ii) would have been lower during the period if certain fees and expenses had not been waived. Performance shown is for the Fund’s Investor Class shares; returns for other share classes will vary. Performance for Investor Class shares for periods prior to December 10, 2004 reflects performance of the applicable share class of Auxier Focus Fund, a series of Unified Series Trust (the “Predecessor Fund”). Prior to January 3, 2003, the Predecessor Fund was a series of Ameriprime Funds. The performance of the Fund’s Investor Class shares for the period prior to December 10, 2004 reflects the expenses of the Predecessor Fund. The Fund may invest in value and/or growth stocks. Investments in value stocks are subject to risk that their intrinsic value may never be realized and investments in growth stocks may be susceptible to rapid price swings, especially during periods of economic uncertainty. In addition, the Fund may invest in mid-sized companies which generally carry greater risk than is customarily associated with larger companies. Moreover, if the Fund’s portfolio is overweighted in a sector, any negative development affecting that sector will have a greater impact on the Fund than a fund that is not overweighted in that sector. An increase in interest rates typically causes a fall in the value of a debt security (Fixed-Income Securities Risk) with corresponding changes to the Fund’s value. Foreside Fund Services, LLC, distributor. The S&P 500 Index (also known as the S&P 500 Cap-Weighted Index) is a broad-based, unmanaged measurement of changes in stock market conditions based on 500 market-capitalization-weighted widely held common stocks. The Russell 1000 Value Index refers to a composite of large and mid-cap companies located in the United States that also exhibit a value probability. The Russell 1000 Value is published and maintained by FTSE Russell. The S&P 500® Equal Weight Index (EWI) is the equal-weight version of the widely used S&P 500. The index includes the same constituents as the capitalization weighted S&P 500, but each company in the S&P 500 EWI is allocated a fixed weight – or 0.2% of the index total at each quarterly rebalance. S&P US Aggregate Bond Index is designed to measure the performance of publicly issued US dollar denominated investment-grade debt. The S&P US Treasury Bill 0-3 Month Index is designed to measure the performance of US Treasury bills maturing in 0 to 3 months. ICE US Treasury 20+ Year Index (4PM), is a 4pm pricing variant of the ICE US Treasury 20+ Year Index, which is market value weighted and is designed to measure the performance of US dollar-denominated, fixed rate securities with minimum term to maturity greater than twenty years. One cannot invest directly in an index or average. As of 6/30/2025 the Fund’s top ten equity holdings were: Microsoft Corp. (6.8%); Philip Morris International (PM) (5.4%); Mastercard Inc. (MA) (5.1%); Kroger Co. (KR) (4.6%); Bank of New York Mellon Corp (BK) (4.2%); Visa, Inc. (V) (3.4%); Bank of America Corp (BAC) (3.1%); UnitedHealth Group Inc. (2.9%); Berkshire Hathaway Inc. Class B (BRK.B) (2.6%); Booking Holdings Inc. (BKNG) (2.4%). The views in this shareholder letter were those of the Fund Manager as of the letter’s publication date and may not reflect his views on the date this letter is first distributed or anytime thereafter. These views are intended to assist readers in understanding the Fund’s investment methodology and do not constitute investment advice. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here